RECON-A: Streamlining SAP Central Finance Reconciliation

In today’s complex financial landscape, data reconciliation between systems is not just a compliance requirement but a critical business process that ensures data integrity and builds confidence in financial reporting. For organizations implementing SAP Central Finance, the reconciliation challenge becomes even more pronounced as they navigate multiple source systems with varying data models and structures.

The Reconciliation Challenge

When businesses interface data from one system to another with different information model dimensions, reconciling between source and target data becomes crucial for several reasons:

- It builds confidence in data accuracy

- It ensures successful system adoption across operations

- It validates that financial information is being properly translated and transferred

However, organizations face significant hurdles when attempting to reconcile financial data:

- There is no one-size-fits-all solution for diverse business needs

- Standard reports often lack comprehensive comparison capabilities across dimensions

- Many teams resort to manual reconciliation processes using spreadsheets, which are time-consuming and error-prone

Standard Solutions vs. Business Reality

SAP provides some standard reconciliation reports for Central Finance implementations:

| Standard Report | Purpose |

| Count of Journal Entries | Checks whether all journal entries from source systems have been posted in Central Finance as expected |

| G/L Account Line Items | Verifies that all FI line items for selected G/L accounts total the same amount across systems |

| G/L Account Balances | Compares debit/credit amounts per G/L account between source and Central Finance systems |

While these reports provide a foundation, most organizations require more detailed reconciliation across multiple dimensions:

- Company code to GL

- Company code to GL profit center

- Company code to GL cost center

- Company code to profit center

Meeting these requirements typically demands significant resources:

- 2+ full-time employees performing manual reconciliation

- Custom reports developed for short-term use

- Specialized market solutions that may not fully address specific business needs

Introducing RECON-A: The Comprehensive Reconciliation Solution

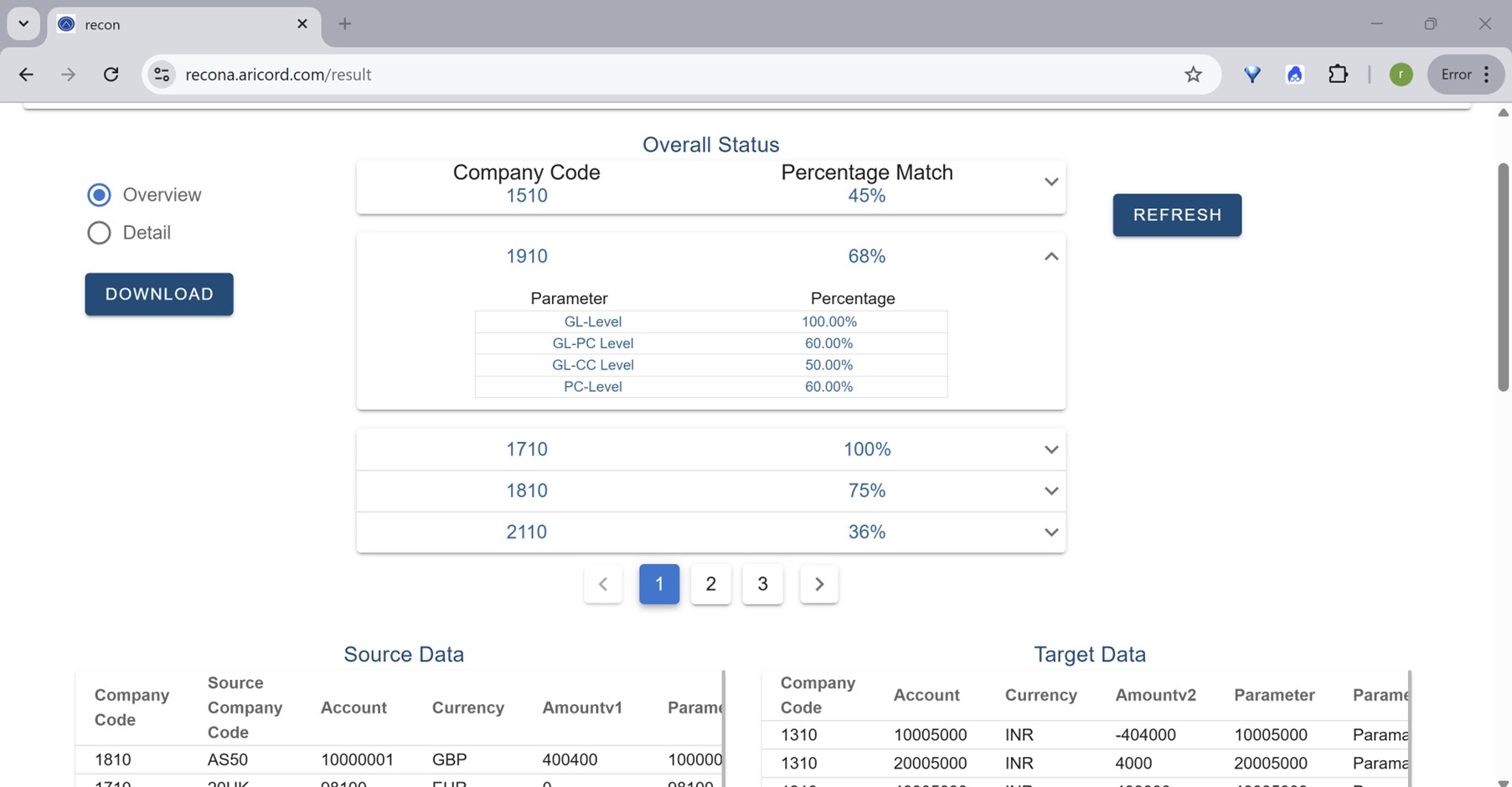

![RECON-A dashboard view showing reconciliation metrics]

Astron Technologies’ RECON-A tool offers a purpose-built solution designed specifically to address the complexities of SAP Central Finance reconciliation. The cloud-based platform enables automated, efficient reconciliation processes that save time and reduce errors while providing greater visibility into any discrepancies.

Key Capabilities of RECON-A

- Comprehensive Reconciliation Coverage

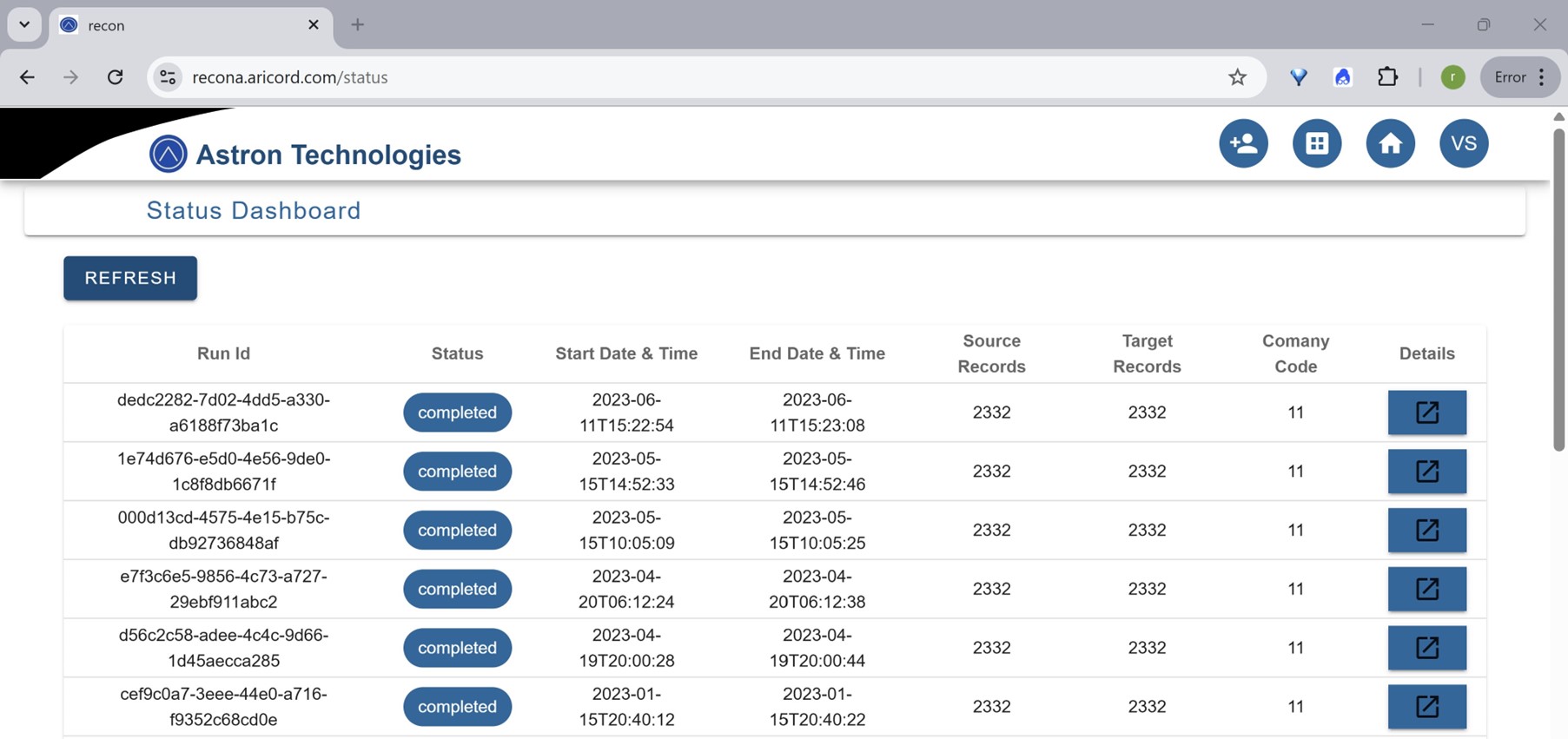

- Supports all key combinations of GL accounts, finance master data (profit centers, cost centers)

- Provides detailed reconciliation across multiple dimensions

- Precise Problem Identification

- Pinpoints exact breaks by legal entity and accounting dimensions

- Helps finance teams focus efforts on specific issues rather than searching through data

- High-Performance Processing

- Handles large data volumes efficiently (10 GB of data processed in under 2 minutes)

- Case study: Processes 90 columns × 100,000 rows in under 4 minutes

- Client-Specific Mapping

- Accommodates custom mapping rules

- Reconciles multiple source and target systems in a single run

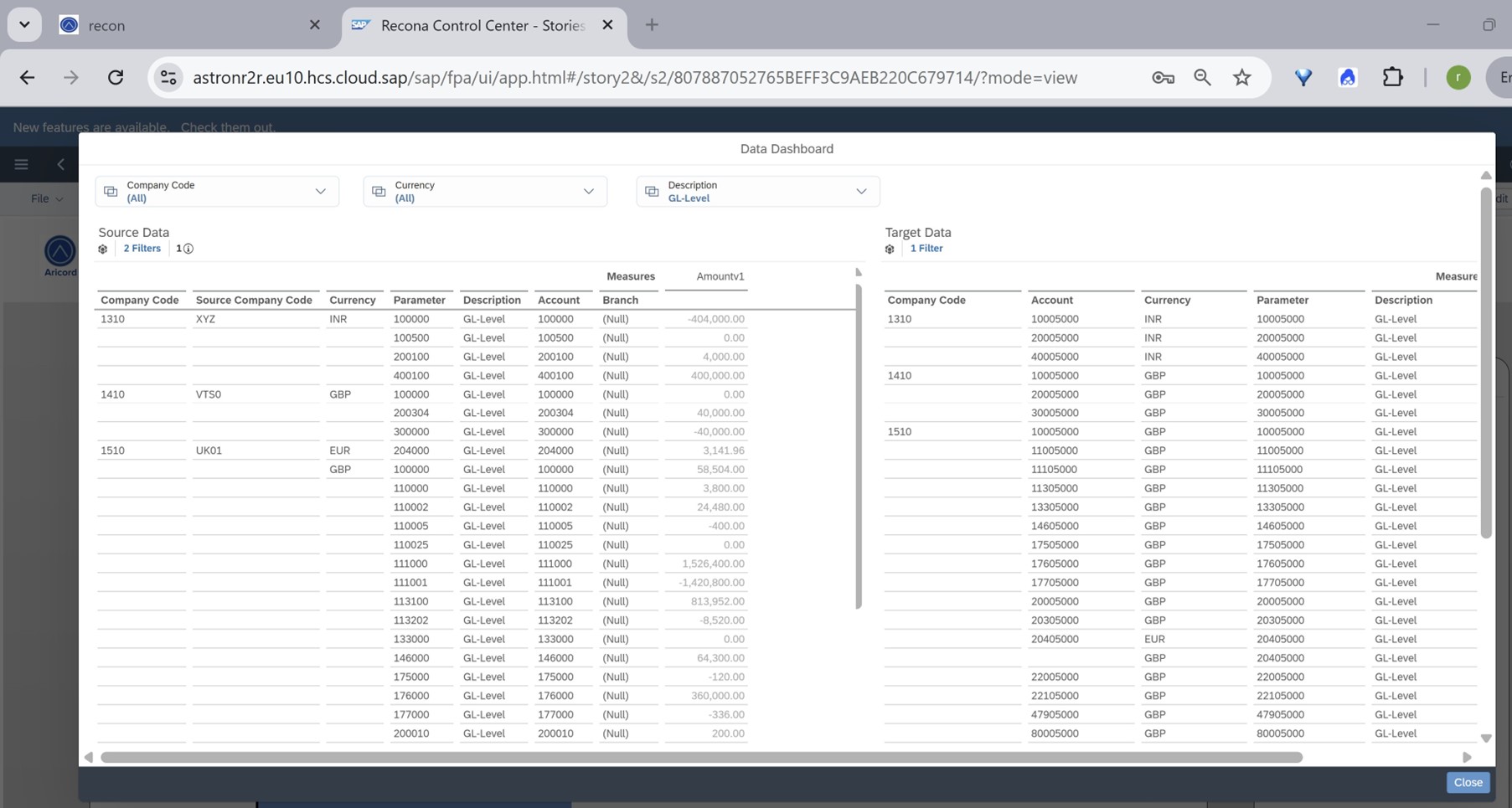

- Execution Monitoring

- Tracks multiple reconciliation runs simultaneously

- Provides status updates and detailed results for each execution

Why Choose RECON-A?

Cloud-Ready

- Deployed in the cloud for accessibility from anywhere

- “Bring Your Own Infrastructure” option or utilize Astron’s hosting

Secure

- Built with industry-standard security features

- Geography-independent with secondary redundancies for reliability

Fast & Efficient

- Optimized to process large datasets quickly

- Reduces reconciliation time from days to minutes

Comprehensive Dashboards

- Real-time, interactive reporting

- Downloadable reports with overview and detailed views

Highly Customizable

- Flexible to meet diverse requirements across business units

- Can be tailored for specific project needs

Multi-User Support

- Allows multiple users to work simultaneously

- Operations customizable to user groups

Cross-System Compatibility

- Reconciles across different technology platforms (SAP, Oracle, D365)

- Handles diverse data formats and structures

![Status dashboard showing multiple reconciliation runs]

Real Business Impact

Implementing RECON-A provides tangible benefits for organizations:

- Reduced Manual Effort: Automation eliminates the need for 2+ FTEs dedicated to reconciliation tasks

- Accelerated Go-Live: Faster reconciliation means faster implementation timelines

- Improved Accuracy: Systematic comparison reduces human error

- Greater Confidence: Detailed reconciliation builds trust in financial data

- Resource Optimization: Finance teams can focus on analysis rather than data validation

The Business Case for RECON-A

For organizations implementing SAP Central Finance, the question isn’t whether they need reconciliation – it’s how to make the process efficient, accurate, and sustainable. Manual reconciliation processes that might be feasible during initial implementation quickly become unmanageable during ongoing operations.

RECON-A transforms reconciliation from a resource-intensive necessity into a streamlined, value-adding process. By providing detailed insights into data discrepancies, it not only validates data integrity but also helps identify and resolve underlying issues in data transformation and mapping.

![Detailed view of source and target data with parameter-level matching]

Getting Started with RECON-A

Implementing RECON-A is straightforward:

- Initial Assessment: Review your reconciliation requirements and data landscape

- Configuration: Set up the tool with your specific mapping rules and parameters

- Validation: Run parallel with existing processes to validate results

- Go-Live: Transition to RECON-A as your primary reconciliation solution

Our cloud-based solution can help your organization reconcile both initial and regular load data for SAP Central Finance projects, providing immediate value and ongoing benefits.

Aricord Consulting Ltd is focused on delivering SAP solutions for accounting, finance, regulatory reporting, performance management, and customer experience. With combined industry experience, our team is dedicated to helping clients perform better through data-driven decision-making, compliance, and operational efficiency.

RECON-A Transforms SAP Central Finance Reconciliation